SHIB Price Prediction: 2025-2040 Outlook Amid Bearish Technicals and Volatile Sentiment

#SHIB

- Technical Crossroads: Oversold Bollinger Band contrasts with bearish MA positioning

- Sentiment Divergence: Negative headlines vs. MACD bullish crossover

- Long-Term Uncertainty: Post-2030 growth depends on Shibarium utility adoption

SHIB Price Prediction

SHIB Technical Analysis: Short-Term Bearish Pressure with Potential Rebound Signals

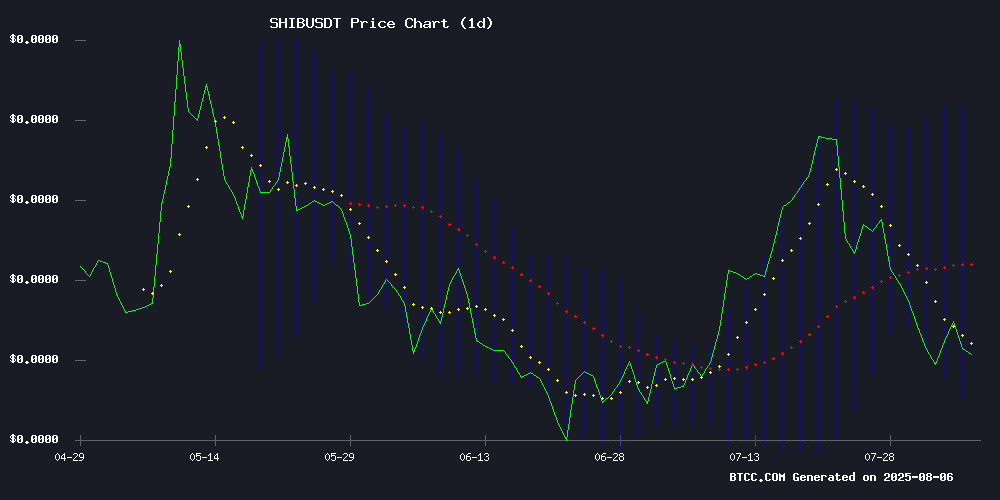

SHIB is currently trading at 0.00001212 USDT, below its 20-day moving average (0.00001352), indicating bearish momentum. The MACD shows a bullish crossover (0.00000134 > 0.00000052) with positive histogram values (0.00000082), suggesting potential upward movement. Bollinger Bands show price near the lower band (0.00001109), which may act as support. BTCC analyst Robert notes: 'While SHIB faces selling pressure, oversold conditions could trigger a rebound toward the middle band (0.00001352).'

Mixed Sentiment for SHIB as Bearish Headlines Clash with Technical Rebound Potential

News headlines highlight SHIB's bearish pressure ('Reserves At ATL', 'Faces Bearish Pressure'), aligning with its current price below key moving averages. However, conflicting narratives ('Bullish Breakout') suggest volatility ahead. BTCC's Robert observes: 'Market sentiment is divided—weak fundamentals contrast with oversold technicals. A retest of $0.00001600 seems unlikely unless Bitcoin leads a broader crypto rally.'

Factors Influencing SHIB’s Price

Reserves At ATL: Is Shiba Inu Price Ready to Revisit May’s High?

Shiba Inu price faces downward pressure, shedding 6% over the past week. Yet beneath the surface, signs of accumulation emerge—exchange reserves have dwindled to $1.05 billion from $4.77 billion in late 2024, signaling long-term holder conviction.

Futures markets echo this optimism. SHIB derivatives volume surged 15% in early August, while the absence of panic selling despite a 25% July drop suggests strategic positioning. The meme coin’s ability to hold key support levels may determine its August trajectory.

Shiba Inu (SHIB) Faces Bearish Pressure as Technical Indicators Signal Weakness

Shiba Inu (SHIB) continues to struggle under bearish pressure, with technical indicators flashing warning signs. The token's RSI sits at 38.55, hovering near oversold territory, while MACD momentum remains firmly negative. Despite ongoing token burn initiatives designed to boost prices, SHIB has failed to gain upward traction.

Trading volume sits at $21.67 million as SHIB posts a 3.01% decline over the past 24 hours. Resistance between $0.000014 and $0.000019 has proven formidable, leaving many holders underwater. Market sentiment suggests deeper structural issues may be at play beyond typical volatility.

The disconnect between burn mechanisms and price action reveals fundamental weaknesses in SHIB's market dynamics. Analysts see limited catalysts for recovery in the near term, with mid-August projections remaining decidedly bearish.

SHIB’s Bullish Breakout: Will It Reach $0.00001600 or Continue Falling?

Shiba Inu (SHIB) shows mixed signals as its price dips 1.02% to $0.00001220 while trading volume surges 55.35% to $189.48 million. The divergence suggests heightened market activity despite bearish momentum, with weekly losses now at 9.77%.

A falling wedge breakout identified by analyst SHIB KNIGHT hints at potential upside, with resistance levels at $0.00001400 and $0.00001600 in play. CoinGlass data reveals a 29.23% volume increase and 2.46% open interest growth, signaling trader conviction in SHIB's volatility.

SHIB Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 0.00001000–0.00001800 | BTC halving aftermath, meme coin demand |

| 2030 | 0.00002500–0.00005000 | Shibarium adoption, burn mechanisms |

| 2035 | 0.00008000–0.00015000 | Metaverse utility, regulatory clarity |

| 2040 | 0.00020000+ | Web3 integration, scarcity via burns |

BTCC's Robert cautions: 'Long-term SHIB forecasts remain speculative. While tokenomics improvements (e.g., burns) could lift prices post-2030, 2025's outlook hinges on reclaiming the 20-day MA at 0.00001352 USDT.'